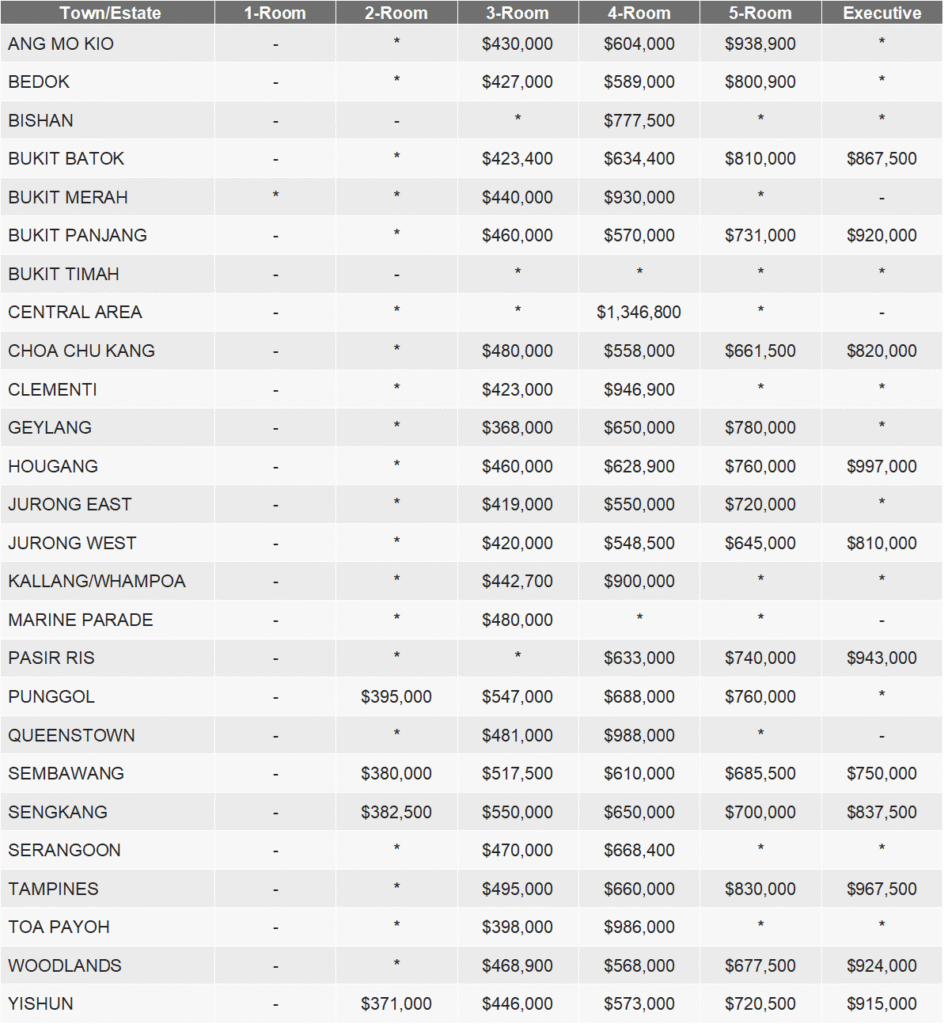

HDB RESALE MARKET TREND

HDB Median Resale Price 3Q 2025

Legend

Here are the notes and legends for the symbols used in the table:

(-) indicates no resale transactions in the quarter

Asterisks (” * “) refer to cases where there are less than 20 resale transactions in the quarter for the particular town and flat type. The median prices of these cases are not shown as they may not be representative.

The data excluded transactions that may not accurately reflect the market price; e.g. resale of part shares, resale between related parties, resale of terrace flats and converted flats

The figures are rounded to the nearest hundred dollars

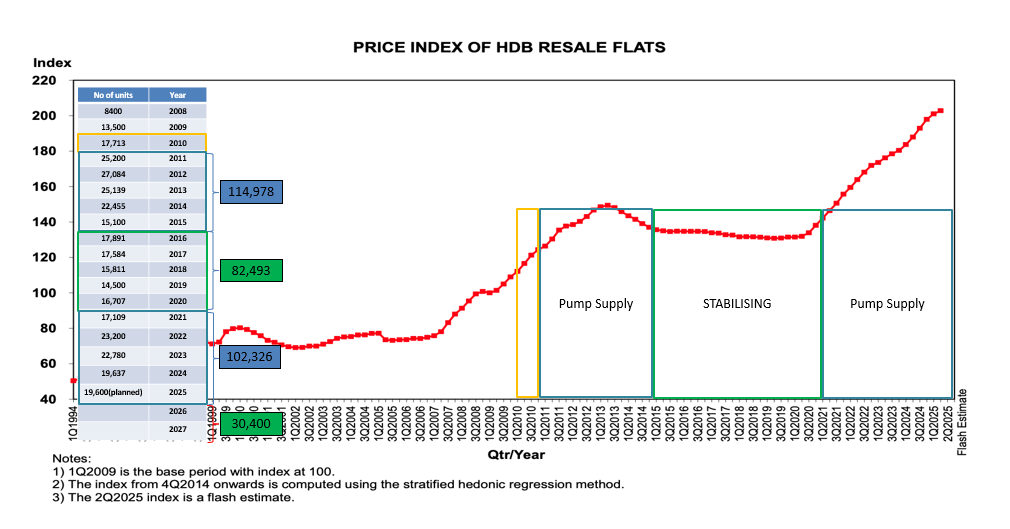

IS IT TRUE THAT HDB PRICE IS ALWAYS GOING UP?

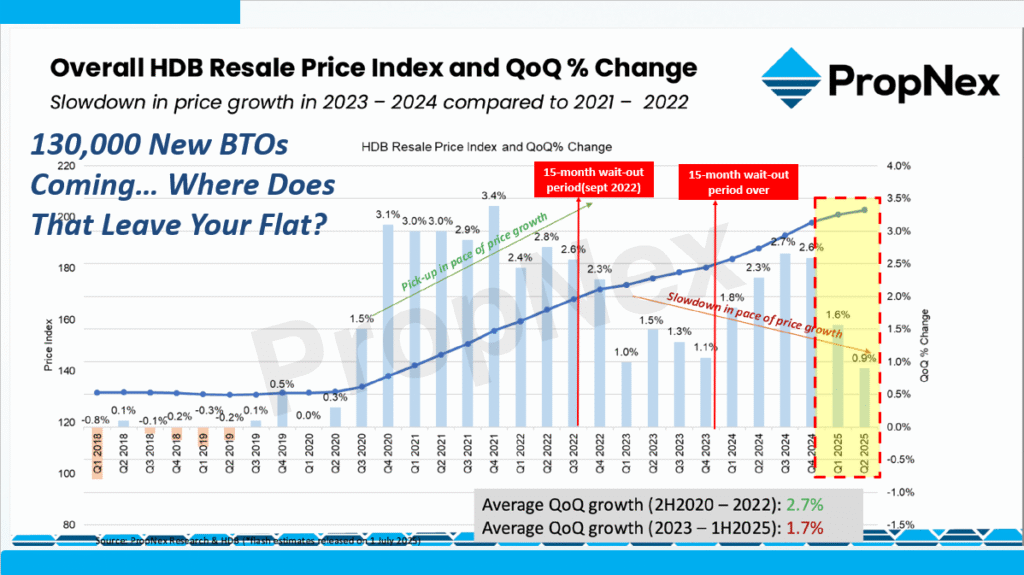

The number of HDB resale transactions plunged 38.4% in October 2025, the lowest volume month since 2020.

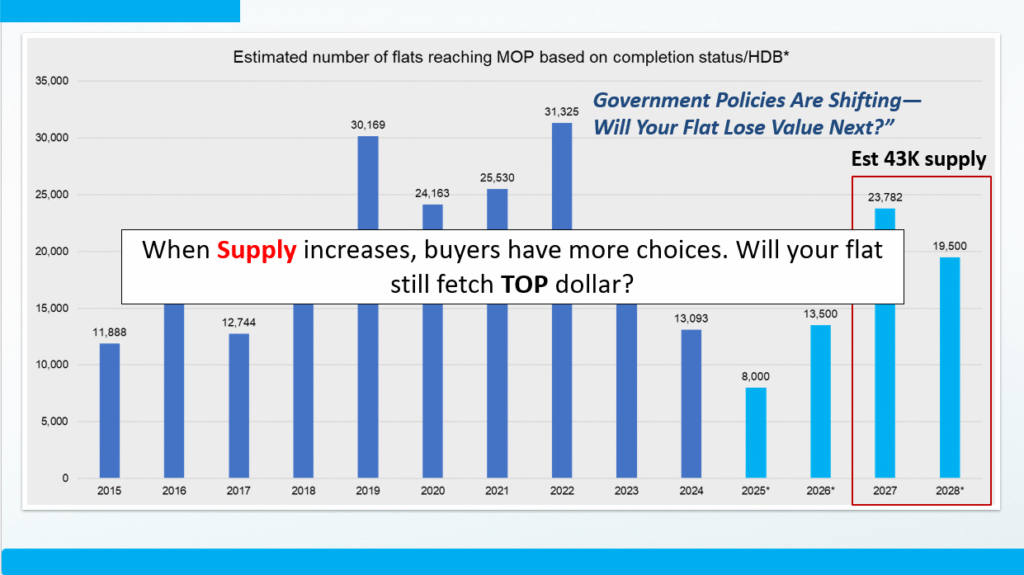

Resale price dipped 0.6 percent. They attributed it to the steady supply of BTO and balance flats which could turned buyers away from the resale market. More than 30,000 flats were launched over the sales exercises in 2025.

The wait-out period for private property downgraders looking to buy a resale flat may be relaxed before 2027, with an expected rise in supply of new and resale MOP flats. This would be consider when the resale market has stabilised and when the supply of resale flats increase, which we think will happen in the next few years because this year is actually the year where the turn will happen.

If the situation continues to improve, then it will allow us to then make the judgement call of when we can remove whether partially or entirely, the 15 month requirement.

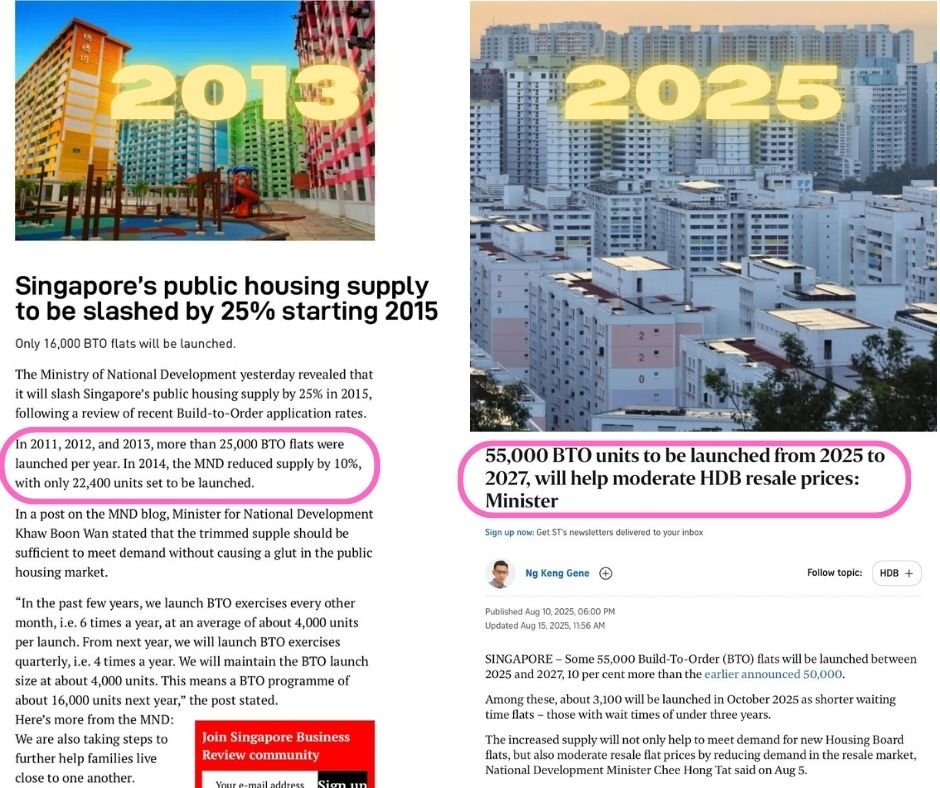

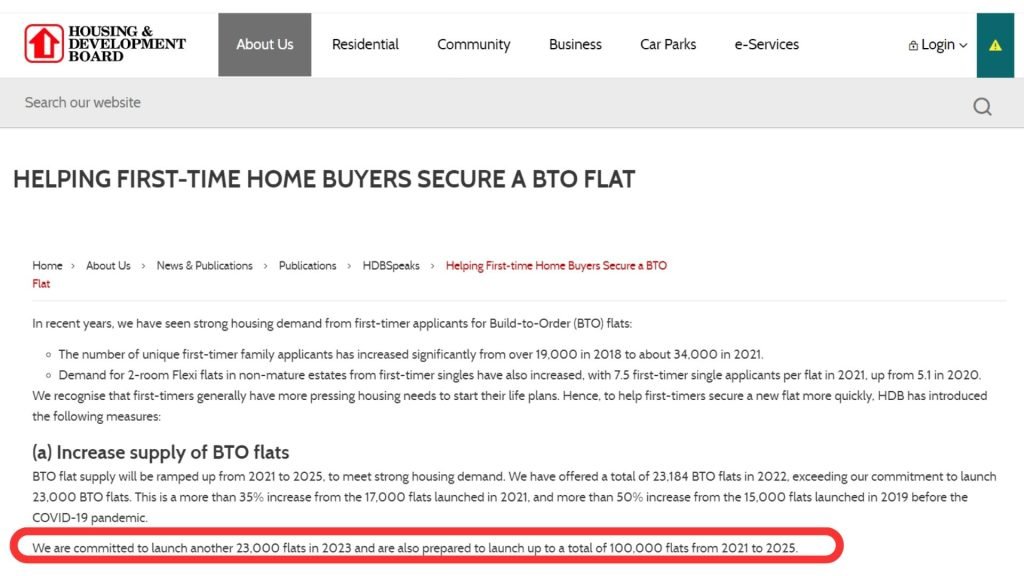

DEMAND VS SUPPLY

The significant increase in the supply of Build-To-Order (BTO) flats was aimed at addressing the strong demand for HDB resale flats, which had likely been a key driver of the previous price increases. This surge in supply has also been one of the main factors contributing to the decline in resale HDB prices since 2013, prior to the COVID-19 pandemic.

HDB COOLING MEASURES

HDB has tightened the loan to value limit for housing loan from 90% to 85% in December 2021.

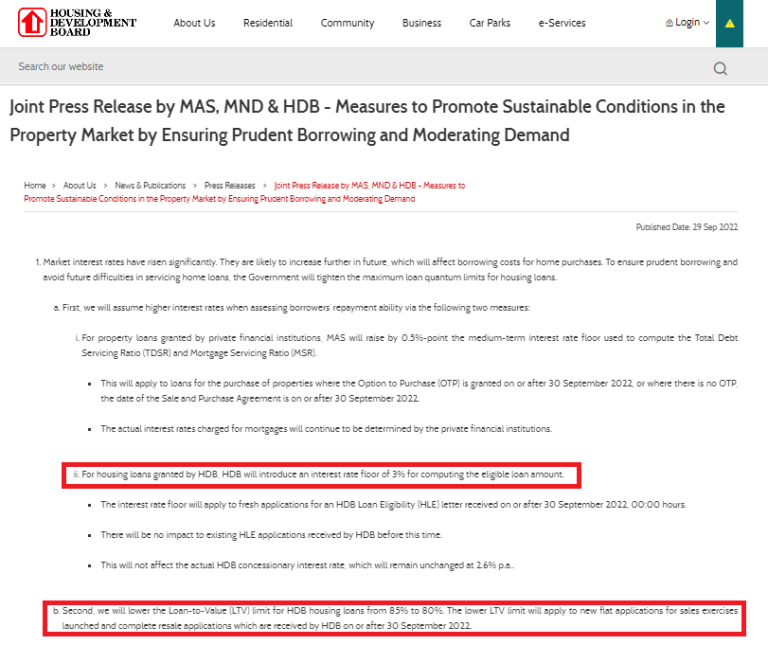

HDB will introduce an interest rate floor of 3% for computing the eligible loan amount.

HDB has tightened the loan to value limit for housing loan from 85% to 80% in September 2022.

HDB has tightened the loan to value limit for housing loan from 80% to 75% in August 2024.

MND introduce a 15 month wait out period for private property owners to moderate demand for HDB and keep them affordable.